Pvm Accounting - Truths

Wiki Article

Some Known Factual Statements About Pvm Accounting

Table of ContentsAll About Pvm AccountingThe 9-Second Trick For Pvm AccountingWhat Does Pvm Accounting Mean?Some Known Factual Statements About Pvm Accounting Pvm Accounting Fundamentals ExplainedAll About Pvm AccountingThe Of Pvm AccountingEverything about Pvm Accounting

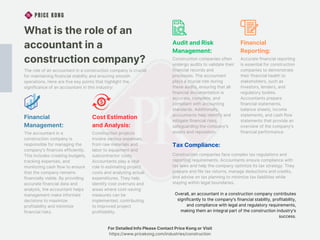

One of the key reasons for implementing accountancy in building projects is the need for economic control and management. Bookkeeping systems supply real-time understandings right into job costs, income, and earnings, making it possible for project supervisors to quickly recognize prospective concerns and take corrective actions.

Accounting systems allow firms to keep an eye on capital in real-time, guaranteeing enough funds are available to cover expenditures and meet monetary obligations. Efficient cash flow management assists protect against liquidity dilemmas and keeps the job on course. https://sitereport.netcraft.com/?url=https://www.victoriamarcelleaccountant.com. Building and construction projects go through numerous economic mandates and reporting requirements. Appropriate audit guarantees that all monetary deals are recorded precisely and that the job adheres to accounting requirements and legal arrangements.

What Does Pvm Accounting Do?

This lessens waste and enhances task efficiency. To better comprehend the relevance of audit in building and construction, it's likewise important to distinguish in between building monitoring accountancy and project administration accountancy. mostly concentrates on the economic elements of the construction firm all at once. It handles total financial control, budgeting, cash money flow management, and economic reporting for the entire company.It concentrates on the economic aspects of private construction jobs, such as cost evaluation, cost control, budgeting, and money flow administration for a particular project. Both sorts of accountancy are important, and they match each various other. Building and construction monitoring accounting guarantees the company's financial health and wellness, while job administration accounting guarantees the financial success of specific tasks.

The Ultimate Guide To Pvm Accounting

A crucial thinker is called for, that will deal with others to choose within their locations of responsibility and to improve upon the areas' job processes. The position will certainly interact with state, university controller personnel, school departmental team, and academic scientists. He or she is anticipated to be self-directed once the preliminary learning contour relapses.

Pvm Accounting Can Be Fun For Everyone

A Construction Accounting professional is in charge of managing the monetary facets of building and construction projects, including budgeting, cost monitoring, monetary coverage, and conformity with governing needs. They work carefully with task managers, specialists, and stakeholders to ensure precise monetary documents, price controls, and timely payments. Their proficiency in building bookkeeping concepts, project setting you back, and economic evaluation is crucial for effective monetary monitoring within the building market.

How Pvm Accounting can Save You Time, Stress, and Money.

As you've most likely found out now, tax obligations are an unavoidable part of doing business in the USA. While many focus usually rests on federal and state income taxes, there's also a 3rd aspectpayroll tax obligations. Payroll taxes are tax obligations on a staff member's gross income. The incomes from payroll tax obligations are made use of to fund public programs; because of this, the funds accumulated go directly to those programs as opposed to the Internal Profits Service (INTERNAL REVENUE SERVICE).Keep in mind that there is an extra 0.9% tax for high-income earnersmarried taxpayers who transform $250,000 or solitary taxpayers transforming $200,000. There is no employer suit for this included tax obligation. Federal Unemployment Tax Obligation Act (FUTA). Incomes from this tax obligation go toward federal and state joblessness funds to help employees that have lost their work.

What Does Pvm Accounting Do?

Your down payments must be made either on a month-to-month or semi-weekly schedulean election you make before each calendar year. Regular monthly settlements. A monthly settlement needs to be made by the 15th of the following month. Semi-weekly settlements. Every other week deposit dates depend upon your pay routine. If your payday falls on a Wednesday, Thursday or Friday, your deposit schedules Wednesday of the following week.Take care of your obligationsand your employeesby making complete payroll tax settlements on time. Collection and payment aren't your only tax obligations. You'll likewise have to report these amounts (and other info) consistently to the IRS. For FICA tax (in addition to federal revenue tax obligation), you have to finish and submit Form 941, Company's Quarterly Federal Tax Return.

Fascination About Pvm Accounting

States have their very own payroll tax obligations as well. Every state has its very own unemployment tax (called SUTA or UI). This tax rate can differ not just by state yet within each state. This is due to the fact that your company's market, years in service and unemployment background can all identify the percent utilized to calculate the quantity due.

The Single Strategy To Use For Pvm Accounting

The collection, compensation and reporting of state and local-level taxes depend on the governments that levy the tax obligations. Each entity has its very own guidelines and approaches. Clearly, the topic of payroll tax obligations entails lots of moving components and covers a large range of accountancy expertise. A U.S.-based global CPA can draw on knowledge in all of these locations when recommending you on your special organization setup.This website makes use of cookies to boost your experience while you navigate via the web site. Out of these cookies, the cookies that are categorized as necessary are kept on your internet browser as they are crucial for the working of basic performances of the web site. We also use third-party cookies that aid us evaluate and understand how you use this website.

Report this wiki page